Submitted by Square_Tea4916 t3_119hbu5 in dataisbeautiful

Comments

cyberentomology t1_j9moif5 wrote

That’s the couch change.

justindoherty405 t1_j9mpknw wrote

I smell an apple lobby and it ain’t for farmersss

[deleted] t1_j9mbzk3 wrote

[removed]

Quentin-Code t1_j9odh7g wrote

Certainly the gift they do to politics that fight for right to repair and sustainability /s

DonovanMcLoughlin t1_j9oe977 wrote

"Good Will" in accounting terms.

RollingstoneMoss t1_j9n36qm wrote

Probably all the AKs they had to invest in.

Mr_Gobbles t1_j9nydbf wrote

Damn fruit companies make a lot of money, I wonder how much the orange farmers make?

cyberentomology t1_j9pjspa wrote

A lot when they sell their orchards to build Disneyland.

[deleted] t1_j9ztk00 wrote

[removed]

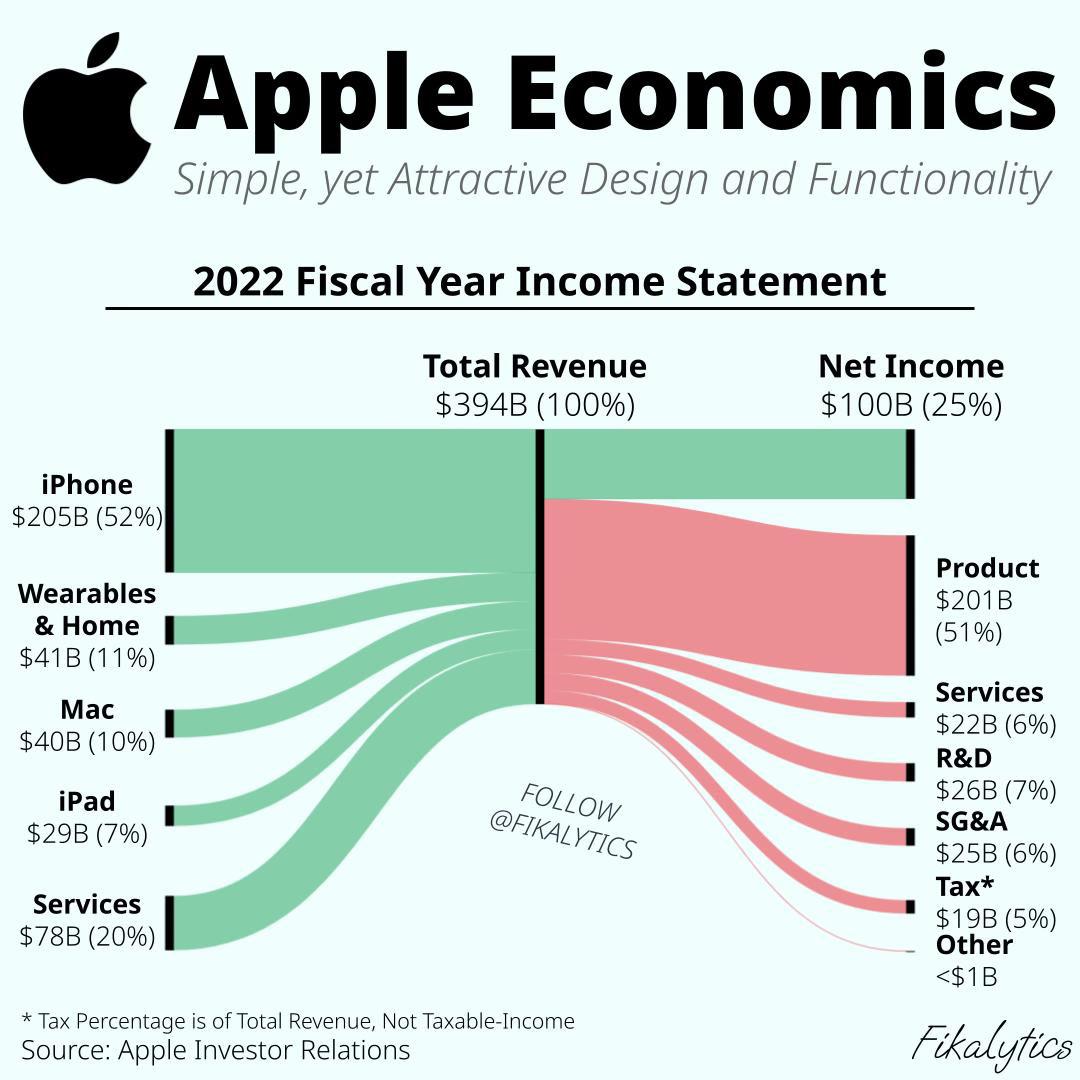

Additional-Local8721 t1_j9n5igj wrote

A 25% ROI with a 5% tax rate.

LSeww t1_j9n8a37 wrote

notice the asterisk

Additional-Local8721 t1_j9n8st3 wrote

Well, seeing that Net Income is ways lower than total assets since NI is rolled into equity, that's even worse. Their effective tax rate is probably closer to 1 or 2% then.

wanmoar t1_j9o4sbj wrote

Simple maths suggests their effective tax rate was around 19%

LSeww t1_j9n9ir9 wrote

Depending on a year, their effective tax rate was from 13 to 26%

TargetMost8136 t1_j9odvy9 wrote

How is their effective tax rate 1-2% if they paid $19bn in taxes

Jerund t1_j9ogy0d wrote

You know how to do math? 19 billion divided by 119billion. Doesn’t look like 1-2% to me. Around 16%

Nairne_ t1_j9omwtz wrote

Counterpoint: that’s not how either of those things work.

goodluckonyourexams t1_j9okl46 wrote

where you see roi here bro

j33tAy t1_j9rn3d1 wrote

It's not there. I think he's making some sort of assumption based off how much they spent on R&D? Or just income divided by revenue?

But that's not how ROI works so...

goodluckonyourexams t1_j9uo131 wrote

that's what I was trying to say with the "bro"

Hattix t1_j9ngnb1 wrote

If the market ever moves away from iPhone, Apple is fucked. At this point, Apple's product line (top to bottom, left side) is iPhone, iPhone accessories, iPhone development kit, big iPhone, and iPhone Cloud.

cervine-scientist t1_j9o92rz wrote

Replace “iPhone” with “iMac” in this comment and it reads like a prognosis from 15 years ago.

Of course, Apple isn’t going to just remain stagnant and allow new technologies to make their primary business obsolete. They’ll do exactly what they’ve been doing for the last few decades and gladly allow new technologies to cannibalize their own products, just as they did with the iPhone replacing the iPod and the iPad replacing the iMac in the vast majority of use cases.

goodluckonyourexams t1_j9okbe6 wrote

"If the market ever moves away from Apple, Apple is fucked"

lifeversace t1_j9o11ru wrote

Market is expected to move from smartphones to smart-glasses in about 10 years, or from iPhone to iGlass (or whatever they decide to call it) to be specific.

goodluckonyourexams t1_j9okgnc wrote

was it the same expectation 10 years ago?

thediesel26 t1_j9or8r7 wrote

Smart glasses will fail for the same reason they failed 10 years ago. Anyone wearing them looks like a smug douche.

HungHung_ t1_j9nqh9v wrote

I would have expected more in r&d

Obvious_Chapter2082 t1_j9poi52 wrote

There’s probably quite a bit of R&D that’s capitalized, so it would be on the balance sheet instead of here

[deleted] t1_j9oars8 wrote

[removed]

Square_Tea4916 OP t1_j9m3hgt wrote

Source: https://investor.apple.com/investor-relations/default.aspx

Tool: SankeyMATIC

Quant2011 t1_j9oe8r6 wrote

for that profit of $100B they could buy all uranium miners on this planet 3 times over.

or all silver produced in the world 5 times over.

but.... what for, if US dollar is more precious?

goodluckonyourexams t1_j9okq12 wrote

if Apple shares* are more precious

app4that t1_j9oycpb wrote

I know Apple used to have a massive mountain of cash, but that seems to be way behind them now as now they have bowed to the market and accumulated $300B in debt..

Can someone explain this puzzling aspect as to why having a mountain of cash ($200B in cash and short term investments) is so bad, but having massive liabilities is considered to be a good idea?

AAPL -

Cash and short-term investments = 48.30B

Total assets = 352.76B

Total liabilities = 302.08B

Total equity = 50.67B

​

jeremevans t1_j9tv5js wrote

It is based on a theory. Essentially, the WACC (weighted average cost of capital).

The idea is that all “Capital” whether from a stock holder or bond holder demands some rate of return. Bonds interest coupons are explicit, stocks return whatever profits remain.

When you think about it that way, adding debt actually allows for more growth/spending because the overall (weighed) rate of borrowing actually decreased before it increases when interest rates are low (and the tax shield helps since some interest in debt is deductible - usually about a third of it).

It’s leverage. It does increase risk. Just imagine if you used a credit card to buy a tool and used this tool to expand your business. Same concept. You’d better be sure that spending will pay for itself.

app4that t1_j9wk6l3 wrote

Thanks - it makes sense except I thought Apple had more cash than anyone so wouldn’t need to do that at all.

Living-Walrus-2215 t1_j9qxthr wrote

> Can someone explain this puzzling aspect as to why having a mountain of cash ($200B in cash and short term investments) is so bad, but having massive liabilities is considered to be a good idea?

There's an opportunity cost in having that cash on the balance sheet, since it's cash that isn't working for a return. If the expected return on keeping that cash is less than the cost of capital, you're effectively burning that cash by keeping it in the company bank account.

This means that unless the company has a good reason to keep it (ie: they want to use it soon for a big investment) they should be returning that cash to its owners, so they can reinvest it elsewhere.

Whether you should be funding your business with debt or equity, depends on your cost of debt and your cost of equity, which in turn depends on your business model.

For a company like Apple, with huge revenue and profit generating capacity without needing substantial capital assets, a good credit rating in a zero interest rate environment, the cost of debt is going to be fairly low and as such funding the business with debt is more attractive than equity.

24get t1_j9oyh1z wrote

5% tax rate! Don’t try this at home.

thekempss t1_j9p07ud wrote

When I see people posting this I want to facepalm. The tax rate is far higher than that!Income is taxed, not the revenue.

Obvious_Chapter2082 t1_j9potyn wrote

16% tax rate, not 5%

Legojoker t1_j9qx3k0 wrote

If I sell burgers, and it costs me roughly $1.00 per burger to purchase the burger ingredients, pay rent on the kitchen/vending location, pay for employees etc, and I sell the burgers for $1.05 each, The thing that gets taxed is the left over profit, ie $0.05. Same principle applies here. Only difference is the progressive tax on corporation profit is virtually non existent (roughly a flat 20% based on the fiscal year). Now, the problems/tax evasion comes from what is considered as part of a business’s overhead. Often, these are exaggerated due to the incentive of being taxed less.

Living-Walrus-2215 t1_j9qzpws wrote

You're forgetting the taxes paid on every cent returned to shareholders (ie: the only profit actually generated to the owners of the business), as well as the taxes paid by its owners, employees, clients as a result of the business operating.

Also it's 19%, not 5%.

I agree though, corporate taxes shouldn't be 5%. They should be 0%.

cyberentomology t1_j9pjpki wrote

Apple has more revenue than Netflix, just on AirPods sales.

[deleted] t1_j9mlf2s wrote

[removed]

SpecialistAd6457 t1_j9n3qhb wrote

What is this type of graph called?

Iwant2FukMyTherapist t1_j9n3ybf wrote

Sankay Diagram

Thaplayer1209 t1_j9n99uv wrote

snakey sankey diagram

[deleted] t1_j9ntvbk wrote

[removed]

leroy_insane t1_j9ocbeb wrote

what's the name of such a graph ?

is there a tool to build it ?

thanks

goodluckonyourexams t1_j9okms2 wrote

see OP's comment

cyberentomology t1_j9pjjoc wrote

$19B of taxes is 19% of 100B, not 5%

crimeo t1_j9q8d25 wrote

It's 5% of their revenue, consistent with all the other parentheticals immediately next to it and consistent with revenue being defined at the top as 100%, not a 5% tax rate.

They even went out of their way to give you an asterisk to clarify for you in case you didn't notice...

cyberentomology t1_j9r5ug0 wrote

Tax percentage on revenue is utterly meaningless.

crimeo t1_j9r6kiz wrote

What do you mean? It shows you how much of the total inflow vs outflow (the whole point of this graph) through the entire company's finances is tax.

It's as meaningful as any other branch of any other Sankey diagram. Obviously people consider them quite meaningful in general, since there's been like 50 of them upvoted to the top of this subreddit recently.

cyberentomology t1_j9r6phz wrote

The dollar amount is meaningful, the percentage is not, as tax is not calculated on revenue.

crimeo t1_j9r7m3s wrote

Nobody claimed tax is calculated on revenue...? Nowhere in the OP does it say "the purpose of this graph is to understand how Apple does their taxes" nor did I say any such thing. Read what I said:

> It shows you how much of the total inflow vs outflow (the whole point of this graph) through the entire company's finances is tax.

Why are people interested in that? I don't know, maybe you should ASK them, instead of deny that the obvious popularity of these graphs is real and gaslight everyone.

Obvious_Chapter2082 t1_j9r96p9 wrote

That’s not what income tax expense is though. It doesn’t have anything to do with the inflow or outflow of tax

crimeo t1_j9r9jb1 wrote

Can you please draw a circle around where in this graph or in any of my comments, you encountered the term "income tax expense"?

My brother in christ, it literally just tells you how big the flowy bit of the sankey diagram is on the right versus the flowy bit on the left, it's not that complicated. YOU'RE the only one talking about (and incorrectly assuming everyone else is too) specific tax jargon and normal/official types of tax metrics.

Obvious_Chapter2082 t1_j9rbzfy wrote

…income tax expense is the tax portion of the chart, it’s literally what you and the other guy were talking about this whole time

You just said that that specific portion of the sankey chart was measuring the inflow and outflow

crimeo t1_j9rcmk6 wrote

The chart makes crystal clear that what it's showing is tax as a portion of revenue.

You said "That’s not what income tax expense is though." So by your own definition, your term you used cannot possibly be referring the chart, since you said it doesn't mean tax / revenue, yet the chart very clearly shows tax / revenue.

Pick one:

-

You're talking about [tax / revenue] (if so, why did you say that that wasn't what the term you used meant if it was...?), OR

-

You're talking about something not in this chart (if so, why are you off topic?)

Obvious_Chapter2082 t1_j9rd5hf wrote

This sankey diagram comes from their income statement. The tax data reported on an income statement is “income tax expense”, which is $19B for Apple, and what’s reported on this specific sankey diagram. It’s what you’ve been referring to, but your wrong that it’s the inflow/outflow of tax, because that’s not what the sankey diagram is showing in the tax amount reported

crimeo t1_j9rdkr2 wrote

> The tax data reported on an income statement is “income tax expense”, which is $19B for Apple

That's the SCALAR amount on the chart.

We have been talking about the PERCENT written next to it.

The percent (5%) is very very clearly indicated on the chart as $19B (all tax paid) / $394B (total revenue) = 4.82% rounds to 5%.

AKA total taxes / revenue. So if you were ever talking about a % other than taxes / revenue, you were simply off topic. Nobody ever claimed that was their tax rate, or anything else, just total taxes / revenue.

Obvious_Chapter2082 t1_j9rdz90 wrote

Again, having a 5% rate there doesn’t mean that their tax was 5% of their revenue though, that’s what I’m trying to say

crimeo t1_j9refg3 wrote

Cool story, nobody claimed it did or that 5% was their tax rate, at any point. Again, why are you just listing random fun facts off topic from the thread in response to nobody?

The graph says it is tax / revenue, it does not say it is their "Tax rate". It did not mix it up, there was never any error, you and the guy at the top of this comment chain just pretended something was said that wasn't, then "corrected" an imaginary error you made up. The chart even went out of its way to give you an asterisk telling you that that wasn't what it was talking about, which you still ignored.

Obvious_Chapter2082 t1_j9rlb8y wrote

Dude, why do you keep shifting your argument?

>19B (all tax paid) / $394B (total revenue) = 4.82%

Again, not true. The 19B isn’t the tax they pay. I’m not claiming there’s an error in the chart, I’m claiming that your analysis of it is incorrect. You’ve said several times that this $19B is the tax they pay, and that’s why I originally told you that was wrong

crimeo t1_j9rm5ze wrote

> I’m not claiming there’s an error in the chart

plus

> The 19B isn’t the tax they pay.

plus

[The fact that the chart quite clearly says "Tax" in red, the color for outgoing costs they paid, with $19B next to it]

You are contradicting yourself. Chart says they paid $19B in tax, you're saying $19B isn't the tax they pay. So therefore yes, you're saying there's an error in the chart. But then you say you're not saying there's an error in the chart.

Obvious_Chapter2082 t1_j9rpsbv wrote

Point to me where the chart says $19B is the tax they pay. Literally the only thing it says is “tax”. You’re the one who keeps saying it’s the tax they pay. Which is why I’m saying that you’re wrong, not the chart

crimeo t1_j9rq7af wrote

> Point to me where the chart says $19B is the tax they pay.

Okay: https://imgur.com/a/AdTIdUi

> Literally the only thing it says is “tax”.

Yes, IN RED which is for paid costs by the company. jfc.

Clear low tier trolling at this point. Bye.

Kindly_Education_517 t1_j9nk5w0 wrote

Who the hell is still buying ipads??????

Shaftomite666 t1_j9o91eq wrote

Jesus, how do you even spend $26 BILLION on R&D?

Always-_-Late t1_j9ocyfc wrote

Takes a lot of money for them to decide to get rid of their home button and metal caseback

goodluckonyourexams t1_j9okt26 wrote

worth it

NotTheTimbsMan t1_j9pwtib wrote

by giving 250k/year to your engineers

DonovanMcLoughlin t1_j9mazj9 wrote

1B as "Other" has me curious.